The RICI®

1.2 THE RICI® AND ITS SUB-INDEXES

Current Index Composition

3.1 INDEX WEIGHTS

The Index Weights remain unchanged as of the end of the January 2019 roll period, which roll period began at the end of January 2019, and are as follows:

Crude Oil

Brent

Natural Gas

Gold

Corn

Cotton

Aluminium

Copper

Silver

Soybeans

RBOB Gasoline

Wheat (CBOT)

Coffee

Lead

Live Cattle

Milling Wheat

Soybean Oil

Zinc

Heating Oil

Platinum

15.00%

13.00%

6.00%

5.00%

4.75%

4.20%

4.00%

4.00%

4.00%

3.50%

3.00%

2.75%

2.00%

2.00%

2.00%

2.00%

2.00%

2.00%

1.80%

1.80%

Gas Oil

Cocoa

Lean Hogs

Nickel

Rapeseed

Rubber

Sugar

Tin

Wheat (CME)

Wheat (MGEX)

White Sugar

Lumber

Rice

Soybean Meal

Orange Juice

Oats

Palladium

Milk Class III

TOTAL

1.20%

1.00%

1.00%

1.00%

1.00%

1.00%

1.00%

1.00%

1.00%

1.00%

1.00%

0.90%

0.75%

0.75%

0.60%

0.50%

0.30%

0.20%

100.00%

5.4 RICI® – ASM INDEX WEIGHTS

Being a sub-index of the Rogers International Commodity Index® (“RICI®”) the exact weight of each of the Rogers International Commodity Index® – Agriculture (“RICI® – ASM“) components is the weight of the index component in the RICI® divided by the weight of the Agriculture segment in the RICI® (34.90%). Hence the Index Weights for RICI® – ASM are:

Corn

Cotton

Soybeans

Wheat (CBOT)

Coffee

Live Cattle

Milling Wheat

Soybean Oil

Cocoa

Lean Hogs

Rapeseed

4.75% / 34.90% ≈ 13.610%

4.20% / 34.90% ≈ 12.034%

3.50% / 34.90% ≈10.029%

2.75% / 34.90% ≈ 7.880%

2.00% / 34.90% ≈ 5.731%

2.00% / 34.90% ≈ 5.731%

2.00% / 34.90% ≈ 5.731%

2.00% / 34.90% ≈ 5.731%

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

Rubber

Sugar

Wheat (CME)

Wheat (MGEX)

White Sugar

Lumber

Rice

Soybean Meal

Orange Juice

Oats

Milk Class III

TOTAL

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

1.00% / 34.90% ≈ 2.865%

0.90% / 34.90% ≈ 2.579%

0.75% / 34.90% ≈ 2.149%

0.75% / 34.90% ≈ 2.149%

0.60% / 34.90% ≈ 1.719%

0.50% / 34.90% ≈ 1.433%

0.20% / 34.90% ≈ 0.573%

≈ 100%

6.4 RICI® – ESM INDEX WEIGHTS

Being a sub-index of the Rogers International Commodity Index® (“RICI®”) the exact weight of each of the Rogers International Commodity Index® – Energy (“RICI® – ESM“) components is the weight of the index component in the RICI® divided by the weight of the Energy segment in the RICI® (40.00%). Hence the Index Weights for RICI® – ESM are:

Crude Oil

Brent

Natural Gas

RBOB Gasoline

Heating Oil

Gas Oil

TOTAL

15.00% / 40.00% = 37.500%

13.00% / 40.00% = 32.500%

6.00% / 40.00% = 15.000%

3.00% / 40.00% = 7.500%

1.80% / 40.00% = 4.500%

1.20% / 40.00% = 3.000%

= 100%

Metals Index

7.4 RICI® – MSM INDEX WEIGHTS

Being a sub-index of the Rogers International Commodity Index® (“RICI®”) the exact weight of each of the Rogers International Commodity Index® – Metals (“RICI® – MSM“) components is the weight of the index component in the RICI® divided by the weight of the Metals segment in the RICI® (25.10%). Hence the Index Weights for RICI® – MSM are:

Gold

Aluminium

Copper

Silver

Lead

Zinc

Platinum

Nickel

Tin

Palladium

TOTAL

5.00% / 25.10% ≈ 19.920%

4.00% / 25.10% ≈ 15.936%

4.00% / 25.10% ≈ 15.936%

4.00% / 25.10% ≈ 15.936%

2.00% / 25.10% ≈ 7.968%

2.00% / 25.10% ≈ 7.968%

1.80% / 25.10% ≈ 7.171%

1.00% / 25.10% ≈ 3.984%

1.00% / 25.10% ≈ 3.984%

0.30% / 25.10% ≈ 1.195%

≈ 100%

Industrial Metals Index

8.4 RICI® IMSM INDEX WEIGHTS

Being a sub-index of the Rogers International Commodity Index® (“RICI®”) the exact weight of each of the Rogers International Commodity Index®- Industrial Metals (“RICI®- IMSM“) components is the weight of the index component in the RICI® divided by the weight of the Industrial Metals segment in the RICI® (14%). Hence the Index Weights for RICI® – IMSM are:

Aluminium

Copper

Lead

Zinc

Nickel

Tin

TOTAL

4.00% / 14.00% ≈ 28.571%

4.00% / 14.00% ≈ 28.571%

2.00% / 14.00% ≈ 14.286%

2.00% / 14.00% ≈ 14.286%

1.00% / 14.00% ≈ 7.143%

1.00% / 14.00% ≈ 7.143%

≈ 100%

Precious Metals Index

9.4 RICI® – PMSM INDEX WEIGHTS

Being a sub-index of the Rogers International Commodity Index® (“RICI®”) the exact weight of each of the Rogers International Commodity Index® – Metals (“RICI® – PMSM“) components is the weight of the index component in the RICI® divided by the weight of the Precious Metals segment in the RICI® (11.10%). Hence the Index Weights for RICI® – PMSM are:

Gold

Silver

Platinum

Palladium

TOTAL

5.00% / 11.10% ≈ 45.045%

4.00% / 11.10% ≈ 36.036%

1.80% / 11.10% ≈ 16.216%

0.30% / 11.10% ≈ 2.703%

≈ 100%

1.1 THE RICI®

The Rogers International Commodity Index® (“RICI®”) is a composite, USD based, total return index, designed by James B. Rogers, Jr. in the late 1990s.

The index was designed to meet the need for consistent investing in a broad-based international vehicle; it represents the value of a basket of commodities consumed in the global economy, ranging from agricultural to energy to metals products. The value of this basket is tracked via futures contracts on exchange-traded physical commodities, comprised of 38 commodities futures contracts, quoted in four different currencies, listed on ten exchanges in four countries.

RICI® aims to be an effective measure of the price action of raw materials not just in the United States but also around the world. Indeed, the index’s weights attempt to balance consumption patterns worldwide (in developed and developing economies) and specific contract liquidity.

The index is designed to offer stability, partly because it is broadly based and consistent in composition, and to meet a need in the financial spectrum currently not effectively covered.

Rogers International Commodity Index® Methodology

The Rogers International Commodity Indexes are maintained by their owner, Beeland Interests, Inc., who is advised by members of the Rogers International Commodity Index® Committee: a group of “wise people” just as are the people who determine the Dow Jones Averages and other major indexes.

For the sake of transparency, consistency, and stability, composition changes are infrequent. The Committee members generally monitor the Indexes daily for circumstances that warrant consideration of changes. The Committee meets formally in November or December of each year to assess the Indexes and discuss changes. Mr. James B. Rogers, Jr., as the founder of the RICI® and sole owner of Beeland Interests, chairs the RICI® Committee and is the final arbiter of its decisions.

The Committee of wise people bases its discussion on world consumption patterns and liquidity. Other indexes may show regular dramatic changes in weights and compositions meaning investors never know in what they are investing. This is not the case with the Rogers International Commodity Index®, which is stable, consistent and transparent. An investor in the Rogers Indexes always knows what he or she is getting.

The RICI® and its sub-indexes are calculated and published in real time.

RICI® Calculation

Indexes, calculated with 9 decimals accuracy, will be rounded to 2 decimal places and can be accessed via the following sources:

FOR CQG SUBSCRIBERS

RICI®-Agriculture Index Excess Return:

RICI®-Agriculture Index Total Return:

RICI®-Energy Index Excess Return:

RICI®-Energy Index Total Return:

RICI®-Metals Index Excess Return:

RICI®-Metals Index Total Return:

RICI®-Industrial Metals Index Excess Return:

RICI®-Industrial Metals Index Total Return:

RICI®-Precious Metals Index Excess Return:

RICI®-Precious Metals Index Total Return:

RICI®-Index Excess Return:

RICI®-Index Total Return:

RICIAER

RICIATR

RICIEER

RICIETR

RICIMER

RICIMTR

RICIBMER

RICIBMTR

RICIPMER

RICIPMTR

RICIER

RICITR

BLOOMBERG

RICI®-Agriculture Index Excess Return:

RICI®-Agriculture Index Total Return:

RICI®-Energy Index Excess Return:

RICI®-Energy Index Total Return:

RICI®-Metals Index Excess Return:

RICI®-Metals Index Total Return:

RICI®-Industrial Metals Index Excess Return:

RICI®-Industrial Metals Index Total Return:

RICI®-Precious Metals Index Excess Return:

RICI®-Precious Metals Index Total Return:

RICI®-Index Excess Return:

RICI®-Index Total Return:

CQG

ROGRAGER

ROGRAGTR

ROGRENER

ROGRENTR

ROGRIMER

ROGRIMTR

ROGRBMER

ROGRBMTR

ROGRPMER

ROGRPMTR

ROGRER

ROGRTR

DIAPASON

RICIAGER Index

RICIAGTR Index

RICIENER Index

RICIENTR Index

RICIMEER Index

RICIMETR Index

RICIIMER Index

RICIIMTR Index

RICIBMER Index

RICIBMTR Index

RICIGLER Index

RICIGLTR Index

REUTERS

RICI®-Agriculture Index Excess Return:

RICI®-Agriculture Index Total Return:

RICI®-Energy Index Excess Return:

RICI®-Energy Index Total Return:

RICI®-Metals Index Excess Return:

RICI®-Metals Index Total Return:

RICI®-Industrial Metals Index Excess Return:

RICI®-Industrial Metals Index Total Return:

RICI®-Precious Metals Index Excess Return:

RICI®-Precious Metals Index Total Return:

RICI®-Index Excess Return:

RICI®-Index Total Return:

CQG

.ROGRAGER

.ROGRAGTR

.ROGRENER

.ROGRENTR

.ROGRIMER

.ROGRIMTR

.ROGRBMER

.ROGRBMTR

.ROGRPMER

.ROGRPMTR

.ROGRER

.ROGRTR

DIAPASON

RICIAGER = DIAP

RICIAGTR = DIAP

RICIENER = DIAP

RICIENTR = DIAP

RICIMEER = DIAP

RICIMETR = DIAP

RICIIMER = DIAP

RICIIMTR = DIAP

RICIBMER = DIAP

RICIBMTR = DIAP

RICIGLER = DIAP

RICIGLTR = DIAP

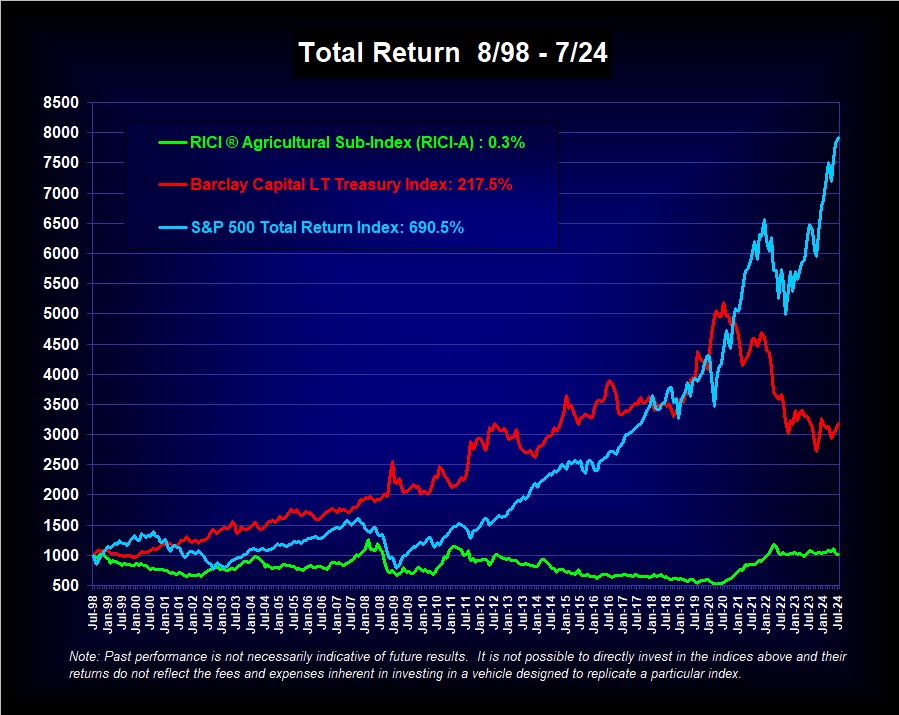

RICI® Performance

RICI® Agricultural Sub Index

RICI® Metals Sub Index

RICI® Energy Sub Index